Florida condo insurance premiums have surged in recent years, with rising costs and stricter requirements impacting thousands of property owners across the state. The average annual premium for condo owners has climbed over 50% in just four years, reaching nearly $2,000, as the Florida insurance market faces ongoing instability and regulatory changes.

Florida Condo Insurance Premiums See Sharp Increases

The issue of rising Florida condo insurance premiums has become a central concern for property owners and associations. According to industry data, the average cost for homeowners insurance in Florida is projected to hit $15,460 in 2025. This figure is nearly five times the national average, highlighting the unique challenges facing the state’s insurance market.

Deductibles have also increased significantly, with a 24.5% jump from 2024 to 2025. This outpaces previous years and adds further financial strain for policyholders. Florida now leads the nation in home insurance non-renewal rates, with many residents experiencing cancellations or non-renewals of their policies.

Market Instability and Contributing Factors

Several factors contribute to the instability of condo insurance premiums in Florida. The state’s vulnerability to hurricanes and extreme weather events places continual pressure on insurers. High litigation rates—previously accounting for nearly 80% of all insurance lawsuits in the United States—have also driven up costs and led some insurers to exit the market.

The 2021 Surfside condominium collapse prompted changes in state law, requiring stricter safety inspections and reserve funding for condo associations. These new requirements have increased operational costs and made compliance more challenging, especially for older buildings.

Impact on Condo Associations

Insurers are now scrutinizing building age, maintenance history, and capital improvements more closely. Many require detailed roof inspections and documentation of repairs before issuing or renewing policies. Older condos and those with deferred maintenance are at higher risk for premium hikes or denial of coverage, according to official sources.

Recent Legislative Reforms and Market Developments

Since 2023, legislative reforms have targeted excessive litigation and aimed to attract new insurers to Florida. As a result, more than 10 new companies have entered the market, according to state officials. However, the effects of these changes are not uniform across the state.

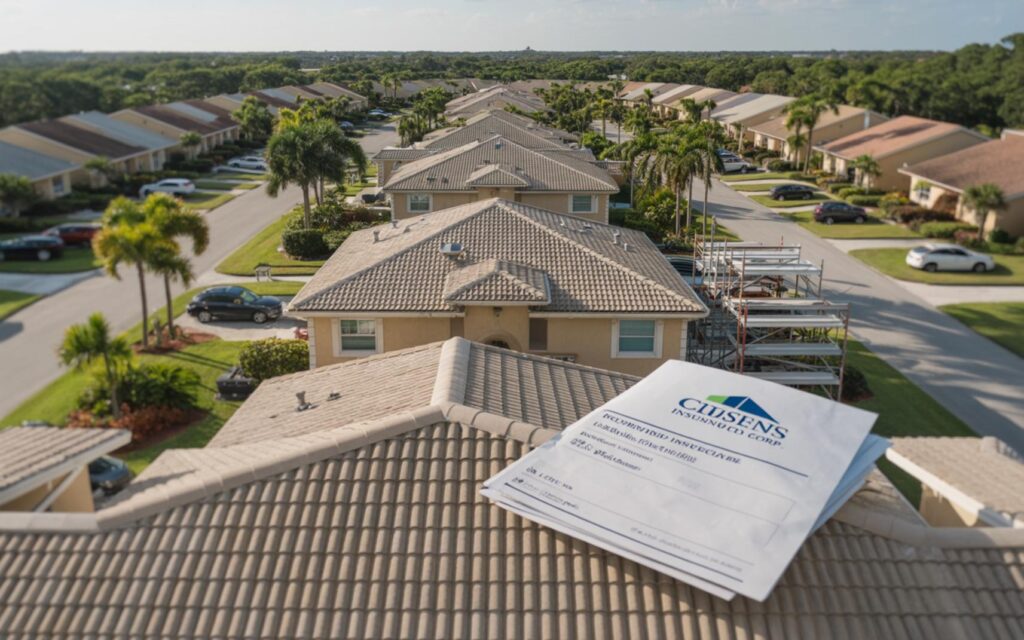

Some areas, particularly barrier islands, may see premium decreases of up to 25%. In contrast, other regions are experiencing increases as high as 80%. Citizens Property Insurance, the state-backed insurer, has reduced its policy count by over 25% in the past 30 months as part of efforts to transition policies back to private insurers.

Citizens Insurance Rate Changes for 2025

For 2025, Citizens Insurance implemented new rate structures. Some policyholders are seeing average decreases of 5.6%, but many condo owners are facing increases exceeding 14%. These changes reflect ongoing adjustments to risk assessment and market conditions.

Stricter Underwriting and Inspection Requirements

Insurance companies are demanding more frequent and detailed inspections, particularly for roofs and structural elements. According to industry reports, these requirements are most stringent for older buildings and those with incomplete maintenance records.

Reinsurance costs and stricter underwriting standards continue to drive up both premiums and deductibles. Insurers are increasingly risk-averse, focusing on property condition, maintenance, and legal exposure when evaluating applications.

Challenges for Older Condominiums

Older condominiums face some of the greatest challenges under the new insurance landscape. Associations must maintain strong reserves and comply with inspection laws to secure coverage and avoid policy cancellations. Failure to meet these standards can result in non-renewal or denial of insurance, according to official sources.

Broader Implications for Housing Affordability

The surge in Florida condo insurance premiums has broader implications for housing affordability and market stability. Some homeowners and condo associations are struggling to meet new reserve and inspection requirements. In some cases, residents are considering dropping coverage due to rising costs, which can expose them to significant financial risk.

Experts indicate that while legislative reforms have helped stabilize parts of the market, recovery remains slow. The combination of climate risk, legal trends, and aging infrastructure means insurance affordability and availability will continue to be a concern for Florida condo owners.

Frequently Asked Questions About Florida Condo Insurance Premiums

What is causing Florida condo insurance premiums to increase?

Florida condo insurance premiums are rising due to frequent hurricanes, high litigation rates, increased reinsurance costs, and stricter safety requirements for buildings. Insurers are also more cautious about property condition and maintenance history.

How much does condo insurance cost in Florida in 2025?

The average annual premium for Florida condo owners is nearly $2,000 in 2025. Homeowners insurance overall is projected to reach $15,460 per year, much higher than the national average.

Are there ways for condo associations to lower their insurance premiums?

Condo associations can help lower premiums by maintaining strong reserves, staying up to date with safety inspections, and making necessary repairs. Providing documentation of maintenance and improvements may also help when applying for coverage.

Can you be denied condo insurance coverage in Florida?

Yes, insurance companies can deny coverage or non-renew policies if buildings have deferred maintenance, fail inspections, or do not meet reserve requirements. Older condos are at higher risk for these issues.

Where are Florida condo insurance premiums increasing the most?

Some regions, especially outside barrier islands, are seeing premium increases as high as 80%. However, certain areas may experience decreases of up to 25%, depending on local risk factors and recent reforms.